“Full Asking” in Today’s Aircraft Market

Four years ago, it felt like anything with wings would sell—fast and high. Buyers stretched to win bids, and even imperfect airplanes moved at premium prices. Today, the froth is gone. Values have cooled, buyers are more selective, and the market has reset. But here’s the important part: good airplanes are still actively transacting—especially when owners understand the real, often invisible, cost of waiting for that perfect, full-asking offer.

This piece unpacks those costs, compares them to a familiar real-estate dynamic, and walks through a concrete Cessna 206 scenario you can adapt to your own situation. If your goal is to sell aircraft efficiently—while protecting market value and net proceeds—this is the playbook for choosing a balanced deal over a long, expensive hold.

Market reality check: cooled, not frozen

Industry reporting through 2025 shows a market that’s normalized from the peak but remains functional for sellers who price to the current moment. For example, IADA’s 2025 quarterly updates describe transactions staying broadly steady year-over-year while pricing drifts modestly lower—more a glide-slope than a cliff. iada.aero+1

Translation: planes priced to today’s buyer move. The ones that linger tend to be the ones priced to yesterday’s mania.

Why waiting is more expensive than it looks

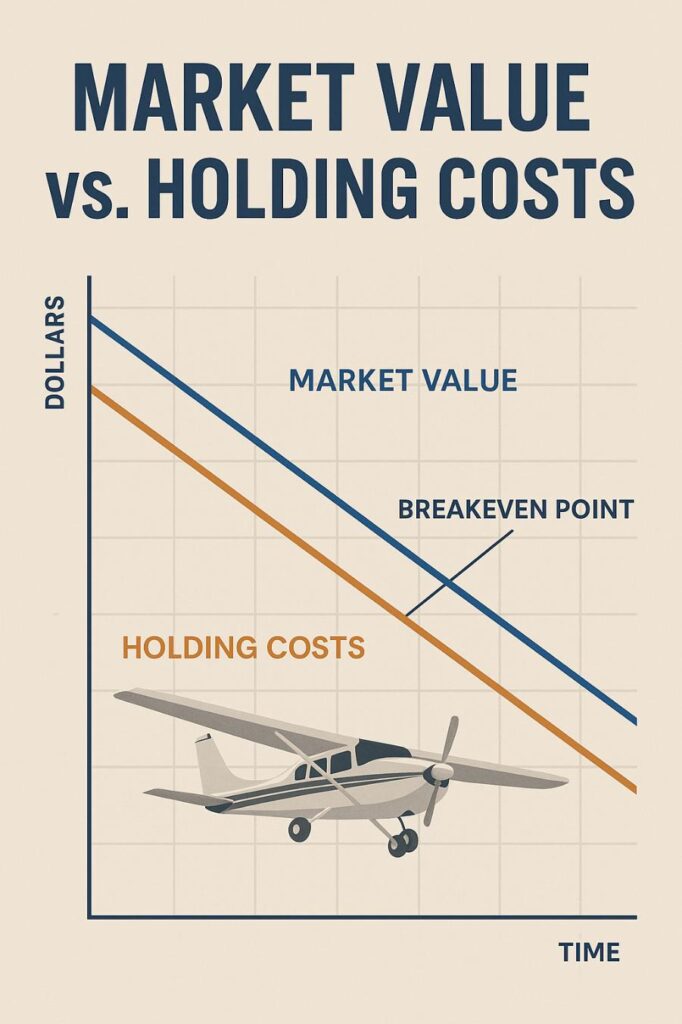

Owners naturally want to “optimize revenue.” But there’s a difference between optimizing gross price and optimizing net results. Waiting for full ask can quietly erode net proceeds through:

- Carrying costs (hangar/tie-down, insurance, taxes, routine upkeep). Typical T-hangar rents range widely—roughly a few hundred dollars per month at smaller fields into the several-hundreds at many others, with busy/prime airports exceeding $1,000/month. Concrete examples: San Luis Obispo lists T-hangars at $450–$720/month, while busy fields can run north of $1,000/month. State surveys show tie-downs commonly $60–$200+/month. SLO County Airport+2Flying Magazine+2

- Insurance keeps renewing even if the aircraft sits; recent guides put typical single-engine premiums in the four figures per year depending on hull value and pilot experience. Pilot Institute+1

- Aging and sitting risk: seals dry, corrosion creeps, avionics age, batteries and rubber time out. That translates into deferred-maintenance discounts at contract time or real cash outlays pre-sale.

- Calendar items: If an annual inspection or other time-based inspection comes due while you wait, you may shoulder it. Shops publicly post flat-rate annuals for 205/206 models around $2.1k–$2.6k (labor only; parts extra). Lore Aviation Services+1

- Opportunity cost: Capital tied up can’t earn elsewhere. With high-yield savings ~up to ~5% APY in late 2025, holding a $400,000 airplane for a year can forgo ~$20,000 in low-risk yield. Fortune+1

- Market drift & staleness: The longer a listing sits, the more buyers assume “there’s a reason,” and the more they push for credits. In a cooled market, time rarely improves leverage.

Put together, time behaves like a slow leak in your net proceeds. And you don’t need a worst-case scenario for the math to tip against “wait for full ask.”

A Cessna 206 scenario: “full asking” versus a balanced deal

Let’s model a typical sell-decision on a normally-aspirated Cessna 206 (legacy airframe with updated avionics; not a new T206H). We’ll assume reasonable national averages you can adjust for your airport, hull value, and usage:

Assume today’s market: A clean, mid-time 206 positioned reasonably might draw $395k–$415k. We’ll anchor on $400,000 as “market-correct,” with the seller tempted to sit for $415,000 “full ask.”

Annual carrying cost assumptions (typical ranges):

- Hangar / storage: $500/month mid-market → $6,000/year (many T-hangars $450–$720; busy airports can exceed $1,000; we’ll stay middle-lane). SLO County Airport+1

- Insurance: $1,800/year (single-engine, experienced pilot; hull value adjusted). Pilot Institute

- Inspection/maintenance buffer: $3,000/year set-aside toward routine items + contingencies (with the annual inspection labor itself commonly ~$2.1k–$2.6k; parts/repairs extra—if timing lands in-cycle during your hold). Lore Aviation Services+1

- Taxes/registration/misc. fees: $1,000/year (varies by state/local).

- Opportunity cost of capital: 5% APY on $400,000 → $20,000/year forgone yield in current rate environment. NerdWallet

Total “time tax” for 12 months (typical, not extreme):

$6,000 (hangar) + $1,800 (insurance) + $3,000 (mx buffer) + $1,000 (tax/fees) + $20,000 (opportunity cost) = $31,800

Now, compare two paths:

Path A — The balanced deal (sell now at market)

- Sale price: $400,000

- Transaction costs (advertising, escrow/title, delivery prep, or brokerage at, say, 5% blended): $20,000

- Net before time tax: $380,000

- Time tax: minimal (close inside 30–45 days), call it $2,500 for one month’s pro-rata carrying/opportunity costs

- Estimated net: ~$377,500

Path B — Wait 12 months for “full ask”

- Gross sale price (eventually): $415,000

- Negotiation realities: buyers often demand credits for sitting/aging items (rubber, battery, ELT battery, IFR cert due, cosmetic issues) or a pre-buy finding. Let’s be gentle and assume -$5,000 in credits → $410,000

- Transaction costs (5% blended): $20,500

- Net before time tax: $389,500

- Time tax (12 months): $31,800

- Estimated net: ~$357,700

Outcome: Waiting a year for a $10,000 higher check actually costs ~$19,800 more in net proceeds compared to the balanced deal taken now (about $377.5k vs $357.7k). And this was with friendly assumptions. If an annual comes due during your hold (very common), parts/repairs easily swing the time-tax higher.

Want a 6-month view? Halve the opportunity cost and pro-rate fixeds (~$16k time tax). Net still tilts in favor of the timely, market-correct sale unless your later buyer truly pays a much higher gross without extracting credits.

Why this mirrors real estate (and why that matters)

Real estate pros harp on “carrying costs” for a reason. Every extra month on market adds mortgage interest, taxes, insurance, utilities, HOA, lawn care, and repairs—all while older listings look stale and invite discounts. Realtor.com’s guidance to sellers is blunt: less time on market generally means fewer carrying costs and stronger offers. Realtor

Broader housing coverage shows the same math in action—shrinking flip margins, rising expense lines, and the penalty for long hold times in a cooler market. AP News

Your airplane isn’t a house, but the psychology and math rhyme: time on market depletes net earnings.

The “sitting penalty” specific to airplanes

Beyond hangar and insurance, aircraft bring unique “sitting penalties”:

- Mechanical degradation: corrosion, flat-spotted tires, stale fuel, battery sulfation, aged hoses and bungees. Buyers (and pre-buy A&Ps) notice.

- Avionics and compliance clock: transponder/altimeter/static checks, ELT batteries, GPS databases—if these items age out while you wait, buyers ask for concessions or you refresh them at your expense.

- Utilization perception: an under-flown engine can be a red flag. A 206 that flies (regular oil analysis, clean borescope reports) is easier to sell at market value.

- Calendar inspections: timing the annual can shift thousands of dollars into your side of the ledger if it lands mid-hold—especially if parts or corrective actions crop up. Typical posted flat-rate labor numbers for 205/206 models run roughly $2.1k–$2.6k before parts. Lore Aviation Services+1

A quick narrative buyers recognize

Picture a well-kept Cessna 206 used for family trips, backcountry fun, and a side of time-builder mentoring with a flight instructor friend (helping new pilots learn to fly). You decide to sell and upgrade. You set full asking above the current comp curve and tell your broker, “I can wait.”

Month 3: one buyer bites—but wants credit for due-soon IFR certs and a tired tire set. Month 5: avionics database expires; oil analysis shows moisture after low utilization. Month 8: you pay the hangar invoice increase (airport raised rates). Month 12: a new buyer appears, offers close to full ask—but requests a 10-day extension after pre-buy to address a couple of deferred items.

You close. The check is bigger—but the net is smaller once you add 12 months of hangar, insurance, inspection timing, and missed investment yield. Meanwhile, the owner who priced for quick sale at market value reinvested months ago and is already flying the next mission. That’s the plane easy path.

Practical guidance: the “balanced deal” playbook

1) Price to the present, not to the peak.

Recent IADA snapshots suggest a stable-to-slightly-softer environment across categories. Your goal is velocity at market-correct pricing, not perfection at a premium. iada.aero

2) Model your personal time tax.

- Find your actual hangar/tie-down rate. (Examples: $450–$720 at SBP; many fields higher or lower; busy airports often $1,000+.) SLO County Airport+1

- Confirm your insurance renewal window and premium. Pilot Institute

- Look at your inspection calendar (annual due date, transponder/altimeter/static, ELT). If you’ll straddle those during a hold, pencil in the real cost (labor + typical parts). Lore Aviation Services+1

- Assign an opportunity cost (what your sale proceeds would reasonably earn—today, 4–5% APY is common for high-yield savings). NerdWallet

3) Decide your trigger points.

What’s the minimum net that makes you happy? Back into that number after carrying costs and realistic credits. If an early offer gets you there, that’s the balanced deal.

4) Keep the airplane “show-ready.”

- Fly it. Keep logs current. Do oil analysis.

- Stay ahead of low-cost cosmetics (plastics, seat wear) that telegraph “well-kept.”

- Don’t let databases, IFR certs, or ELT batteries lapse mid-listing if you can help it.

5) Emphasize buyer confidence.

A crisp spec sheet, organized logs, fresh photos, borescope images, and clarity on SBs/ADs feel like good customer service and preserve market value. The smoother the presentation, the less oxygen for discount requests.

For brokers & instructors: how to talk about this with clients

When you represent a seller—or you’re a flight instructor advising an owner who’s ready to move on—make the conversation about net. Show two “deal paths”:

- Market-correct now (likely quick sale) vs.

- Full-ask hold (time tax + higher chance of credits + calendar risk).

Visuals help. A simple two-column worksheet with actual hangar/insurance, a line for annual timing, and an opportunity cost line at today’s APY makes the decision obvious. When your client sees that a “$10,000 more” gross can mean “$20,000 less” net, choosing the balanced deal becomes easy.

TL;DR for owners who want it “plane easy”

- The market is cooled but active. Well-priced airplanes still move. iada.aero

- Time on market has a real price: hangar/tie-down, insurance, inspection timing, aging/sitting discounts, and opportunity cost (today, cash can earn ~5%). NerdWallet+5SLO County Airport+5Flying Magazine+5

- On a Cessna 206, a year of waiting for full ask can easily cost five figures in net.

- A balanced deal—a fair, market-correct quick sale—often wins on net, not just speed.

If you’re ready to sell aircraft and want a transparent, data-rich process that keeps you in the pilot’s seat, choose the plan that protects your net, not just your list price.

Notes on the numbers

- Hangar/storage: SBP’s public T-hangar rates ($450–$720/mo) illustrate a mid-market range; national press notes $1,000+/mo at busier fields. SLO County Airport+1

- Insurance: Single-engine owner premiums commonly in the low-thousands; adjust for hull value, pilot experience. Pilot Institute+1

- Annual inspection (205/206): Posted flat-rate labor examples ~$2.1k–$2.6k before parts/repairs. Lore Aviation Services+1

- Opportunity cost: late-2025 high-yield savings often around 4–5% APY; plug your preferred rate. NerdWallet